Texas Real Estate Broker Exam Prep

Pass the Texas real estate broker exam with confidence! All of our 1,000 Texas real estate practice exam questions are similar to the ones you will find on the actual Texas real estate exam, and are written by a Licensed Real Estate Instructor. Our Texas real estate practice exams are up to date with the latest 2025 rules and regulations, and are guaranteed to help prepare you to pass the entire TX real estate licensing exam!

Pass The Texas Real Estate Broker Exam - START NOW

Our Texas real estate exam prep has helped thousands of test-takers pass their TX real estate test, and comes with unlimited access to over 500 TX practice real estate exam questions, and 450 vocabulary test questions with detailed answer explanations!

Texas Real Estate Broker Exam Questions

OUR REAL ESTATE EXAM PREP INCLUDES...

500 Real Estate Exam Questions

450 Vocabulary Test Questions

50 Real Estate Math Questions

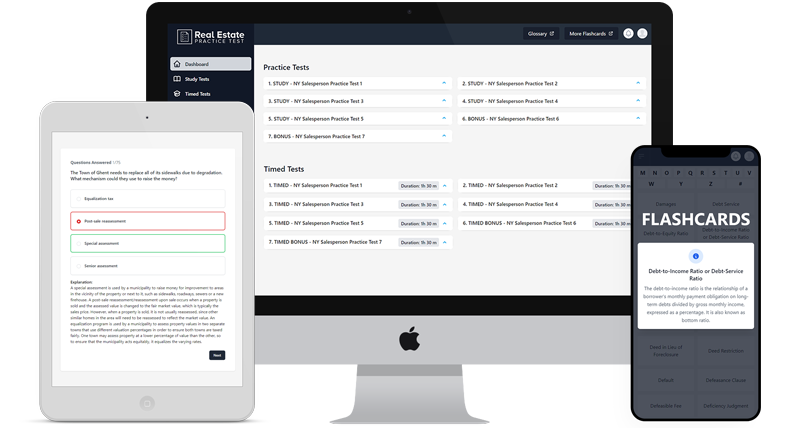

User-Friendly On All Devices

1 Week / 1 Month / 3 Month Access

2025 Rules & Regulations

Vocabulary Study Flashcards

Help From A Licensed Instructor

Real Estate Exam Tip Videos

Real Estate Vocabulary Glossary

Practice Mode & Live Exam Mode

100% Pass Money-Back Guarantee